АО "UNIFIED PENSION SAVINGS TRUST"

As of 01.01.2019, the total number of individual pension accounts (IPA) amounted to 10,381K units. Of these, 95% are IPA for accounting for compulsory pension contributions (CPC), 480K accounts for accounting for compulsory professional contributions (CPPC) and 48K accounts for accounting for voluntary pension contributions (VPC).

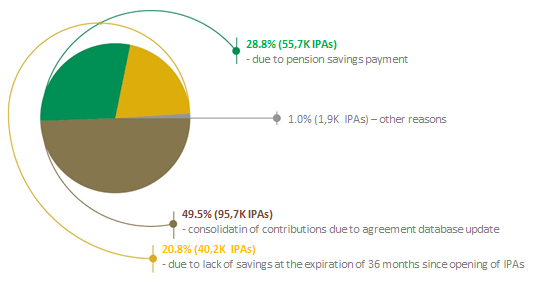

In 2018, the number of IPA increased by 261,2K units or by 3%. In the reporting period, 454,9K accounts were opened for new Fund contributors and 193,5K were

Actualization of pension agreements in the Fund’s automated information system database led to decrease in the number of unidentified IPAs (without agreement) by 110,1K units and as of January 1, 2019 totaled 216,3K units.

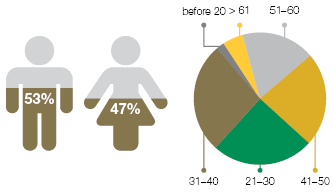

Of all 9,4 mln CPC accounts with agreement and savings, 5,0 mln accounts belong to men and 4,4 mln accounts — to women; 8,9 mln accounts belong to contributors, and 0,5 mln accounts — to recipients (individuals who had reached retirement age, and for whom applications for pension entitlements had been filed in connection with disability, change of place of residence and death). At the same time, the share of active IPA contributors in the reporting period made up to 72% (6,4 mln accounts out of 8,9 mln accounts), comparing to 2017, the share of active ones composed 69% (5,9 mln accounts out of 8,7 mln accounts).

IPA per CPC with agreement and pension savings structure (by owner gender, age and status)

The average savings of contributors of CPC among men amounted to 1,101.2K tenge, among women – 842,4K, in pre-retirement age (men 60–62, women 56–58) – 1,357.3K tenge and 1,237.7K tenge respectively. The amount of pension savings of contributors (recipients) directly depends on the term of participation in the accumulative pension system. The average amount of pension savings of contributors who have carried out regular CPC over the entire period of the APS functioning is 5,1 mln tenge for men and 3,9 mln tenge for women. The number of contributors who can get retirement annuity among men (aged 54–63 with savings over 9,7 mln tenge) is 6.3K people (or 0.1%), among women (aged 50–63 with savings over 13,3 mln tenge) – 1,2K people (or 0.03%).

АО "UNIFIED PENSION SAVINGS TRUST"

Pension savings

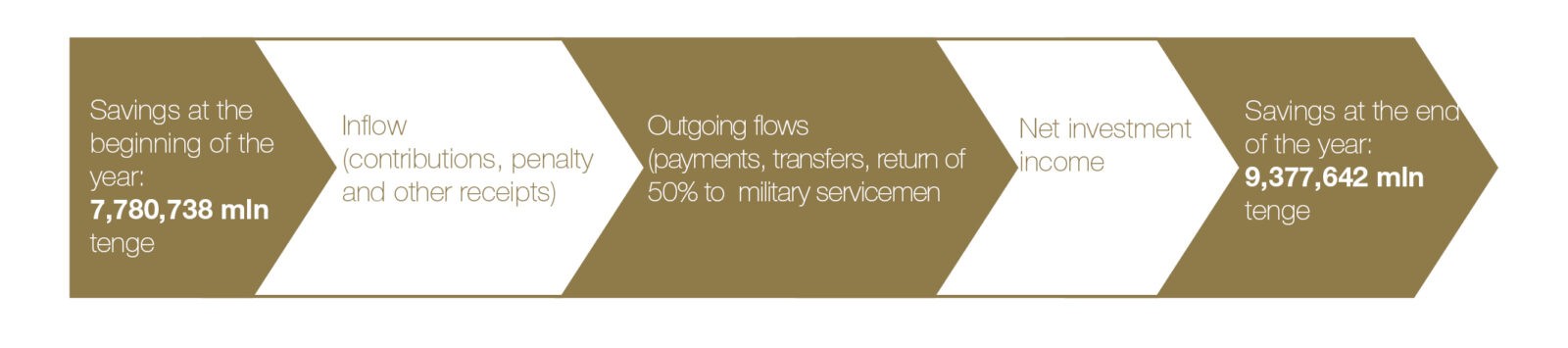

As of January 1, 2019, the amount of pension savings was 9,377,642 mln tenge that increased by 1,596,904 mln tenge or 21% for the reporting period. According to preliminary data, ratio of pension savings to GDP of the Republic of Kazakhstan for 2018 is 15.95% (comparing to 2017 – 14.65%).

The increase in the amount of pension savings in the reporting period was due to:

+ 848,686 mln tenge

- 168,638 mln tenge

+ 917,103 mln tenge

In 2018, 74 mln of pension contributions on all types of agreements were transferred to the Fund totaling 847,382 mln tenge. 70.5 mln of contributions amounted to 807,613 mln tenge (95.3%) are CPC; 3,5 mln of contributions amounted to 39,510 mln tenge (or 4.7%) are CPPC; 33K of contributions amounted to 259 mln tenge (0.03%) are VPC. As compared to 2017, the number of contributions in 2018 increased by 10%, while the amount of contributions received in 2018 exceeded the amount of 2017 by 12%.

At the end of 2018, more than 6,4 mln people made at least one contribution. At the same time, from 6 to 12 contributions were received on 5 mln accounts. On average, the number of contributions of each contributor was 8–9 contributions in 2018.

6,2 mln of contributions were received in the total amount of 70,615 mln tenge on average every month for all types of agreements in 2018. The amount of monthly average contribution consisted 15,8K tenge with an average monthly salary from 148,7 to 174,6K tenge according to the data of Statistics Committee.

Investment income accrued on pension assets for 2018 amounted to 977,180 mln tenge (comprising 64% for 2017). At the same time, net investment income (net of commission fees) amounted to 917,103 mln tenge (67% for 2017).

Investment portfolio

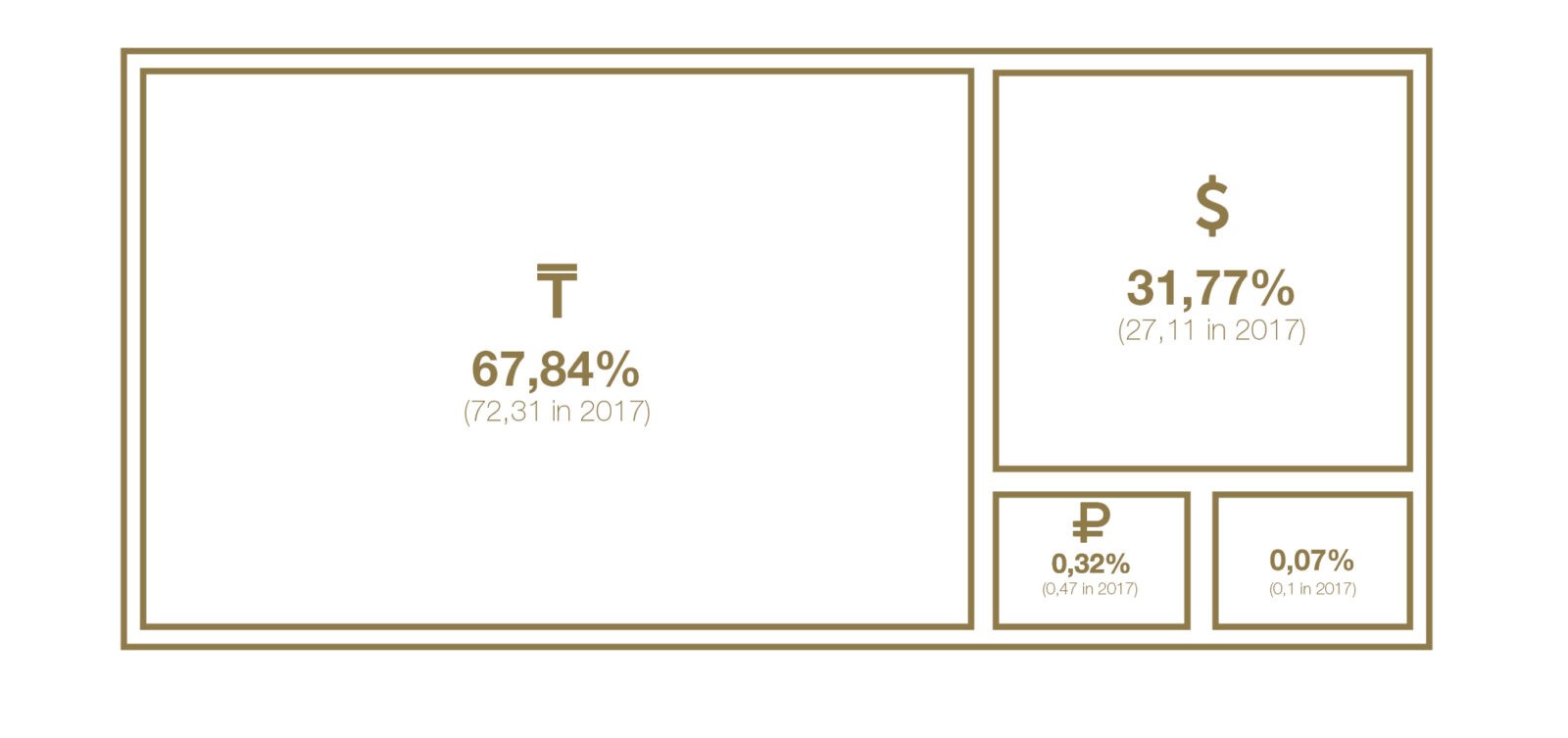

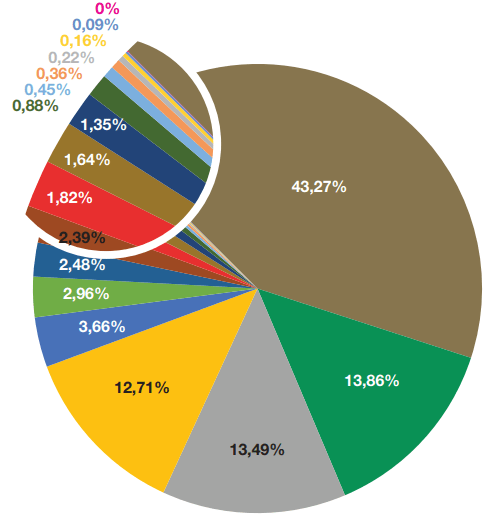

The main share in the income structure for the reporting period as in the previous year had income in the form of interest (coupon or discount) on securities, including on placed deposits and reverse repurchase agreements (56%). The second place in the share of the investment income structure had the revaluation of securities and currency (42%), the third place — income from assets under external management (1%) and others. The pension assets portfolio structure of the Fund (in terms of currencies and instruments):

As of January 1, 2019, the weighted average return to maturity of debt financial instruments in the investment portfolio of the UAPF pension assets comprised 7% per annum, including 8.2% for assets denominated in tenge and 4% for assets denominated in foreign currency. The actual return on pension assets for the reporting period calculated on the basis of increase in the cost of conventional pension unit, which records pension assets, was 11.27%, which is 5.97 percentage points higher than the cumulative inflation rate for the specified period, which comprised 5.3%.

Pension payments

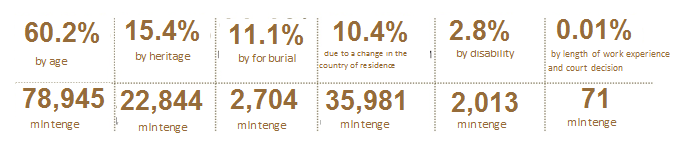

Payments of pension savings from UAPF, including transfers to insurance companies, in 2018 amounted to 168,638 mln tenge (20% of the 2017). Decrease of pension payments (by age) in the reporting period is due to transition to monthly payments and the beginning of a phased increase in the retirement age of women. So, the number of accepted applications for payment in 2018 amounted to 240.4K (17.9% of the 2017 indicator):

The actual number of payments in 2018 exceeded the 2017 indicator by 82%, totaling 619,3K units. At the same time, the number of recipients – 281,9K, which is 12% lower than last year. The monthly average payment to recipients who retired as of 01.01.2018 according to the schedule was 20,177 tenge, the minimum – 15,3K, the maximum – 502,375 tenge.

Also, the amount of pension payments includes transfers of pension savings to insurance organizations under pension annuity agreements, which in 2018 amounted to 26,081 mln tenge. The number of recipients totaled 2,157 in the reporting period (7% less than in 2017), due to an increase in pension savings that was sufficient to conclude a pension annuity agreement. The average transfer amount per recipient amounted to 12.1 mln tenge.

Statement of the Chairman

In 2018, Kazakhstan’s fully-funded pension system celebrated its 20th anniversary. A fully-funded pension system can only be considered as mature 40 years after its inception, when at least one generation has completed a full career cycle of membership in the system, which requires making regular contributions.